Portfolio

Projects

Educational

Credit Risk Predictive Analysis

General Information

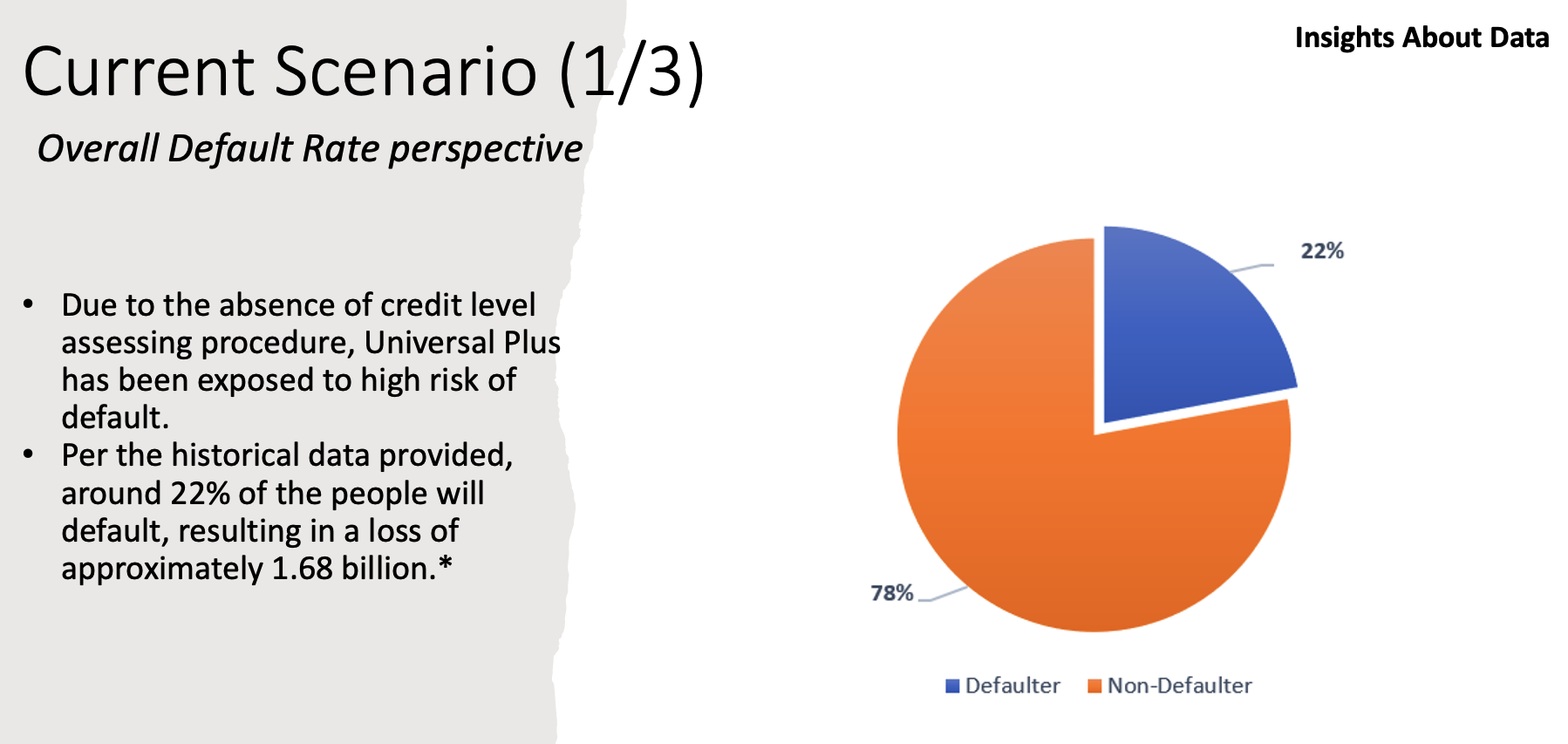

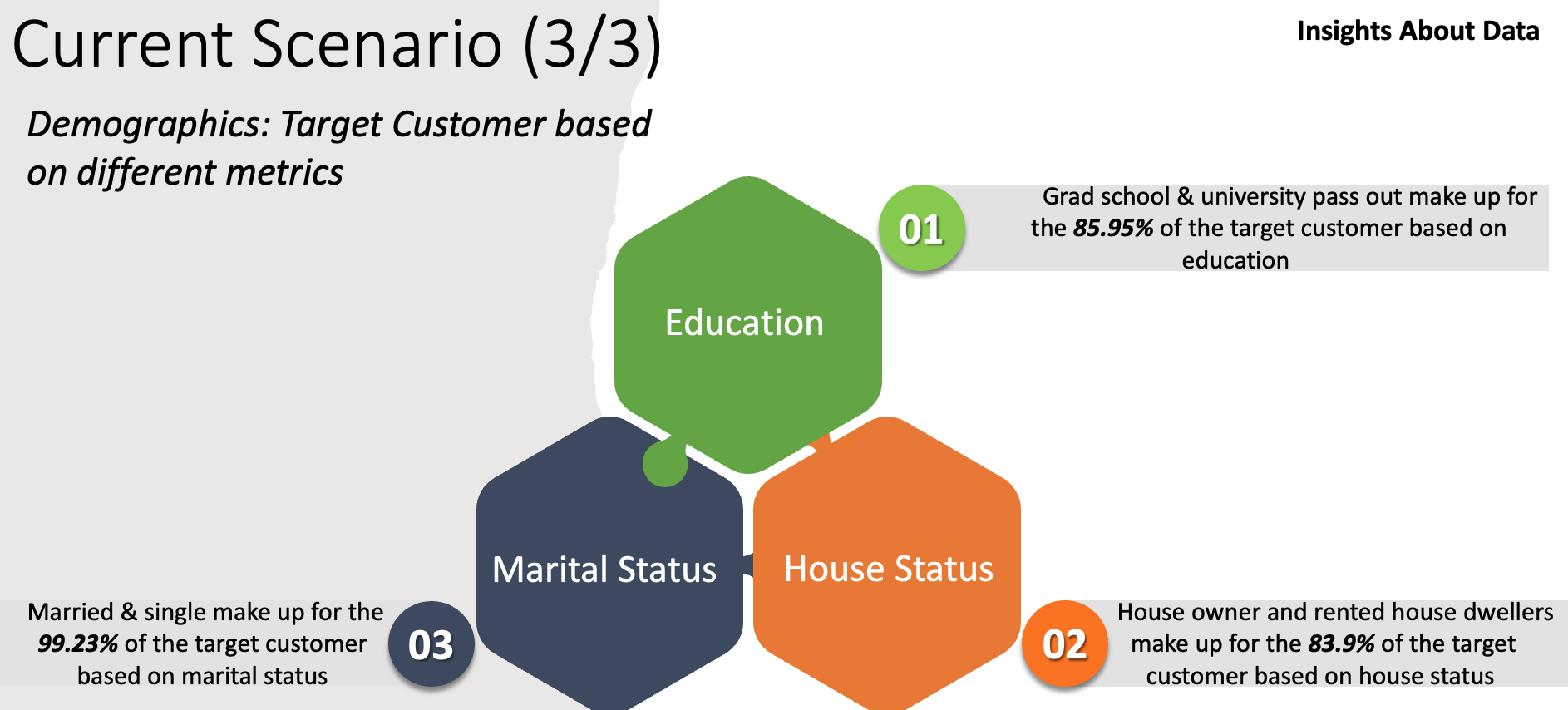

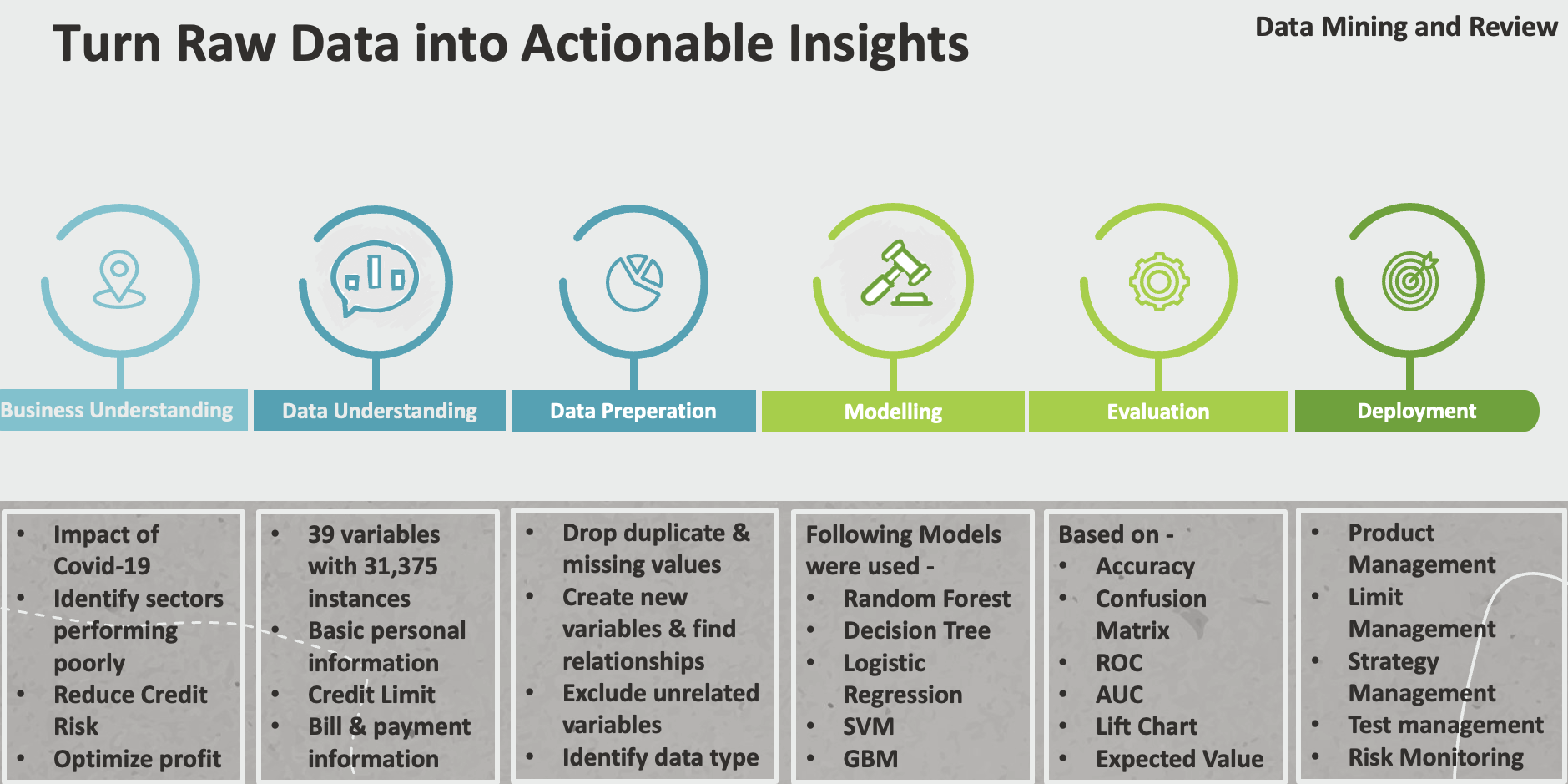

This project resembles work done by an analytics consultancy company. A private financial institution, “Universal Plus”, requested a pitch to win a major contract with them to develop and deploy a credit risk management system.

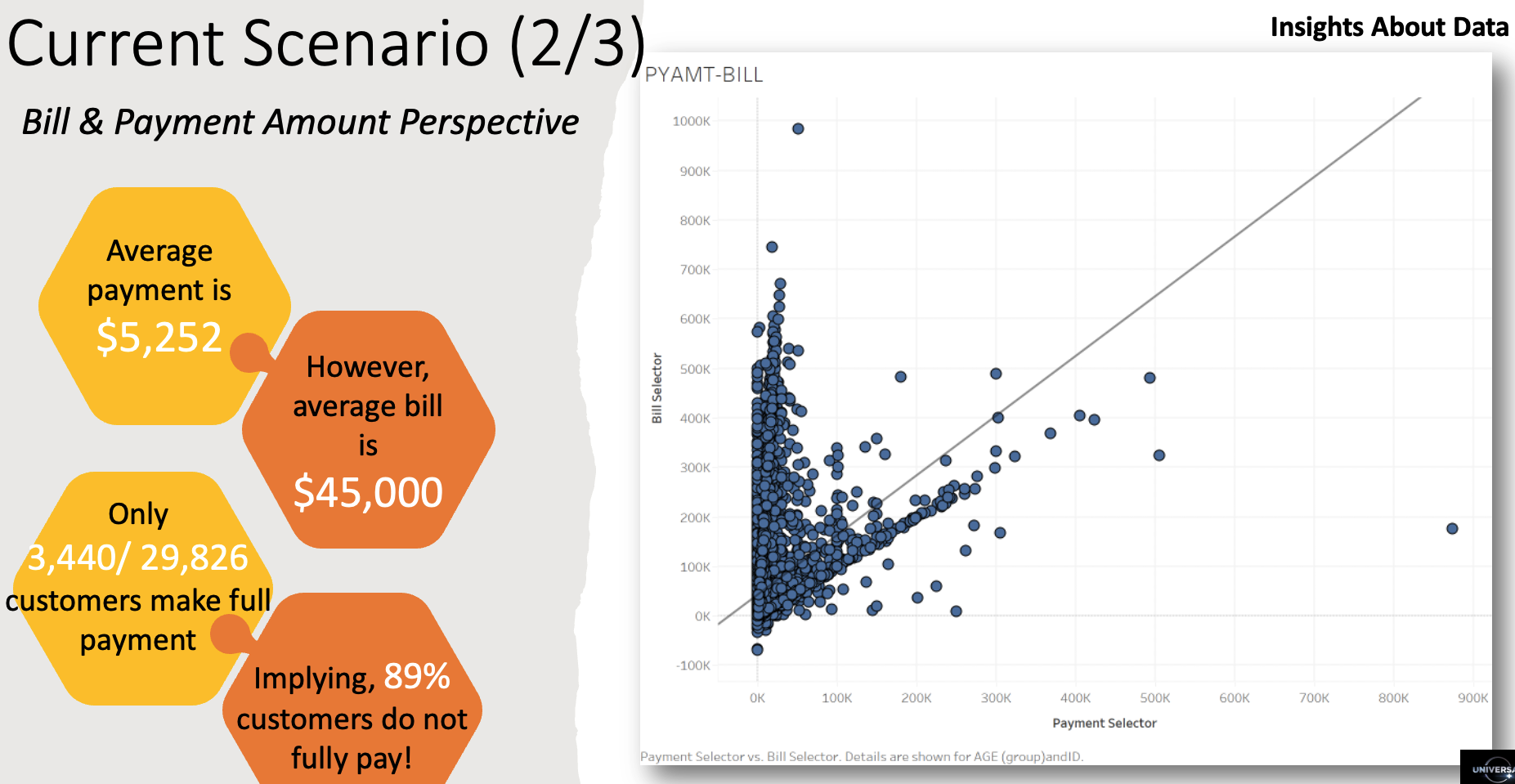

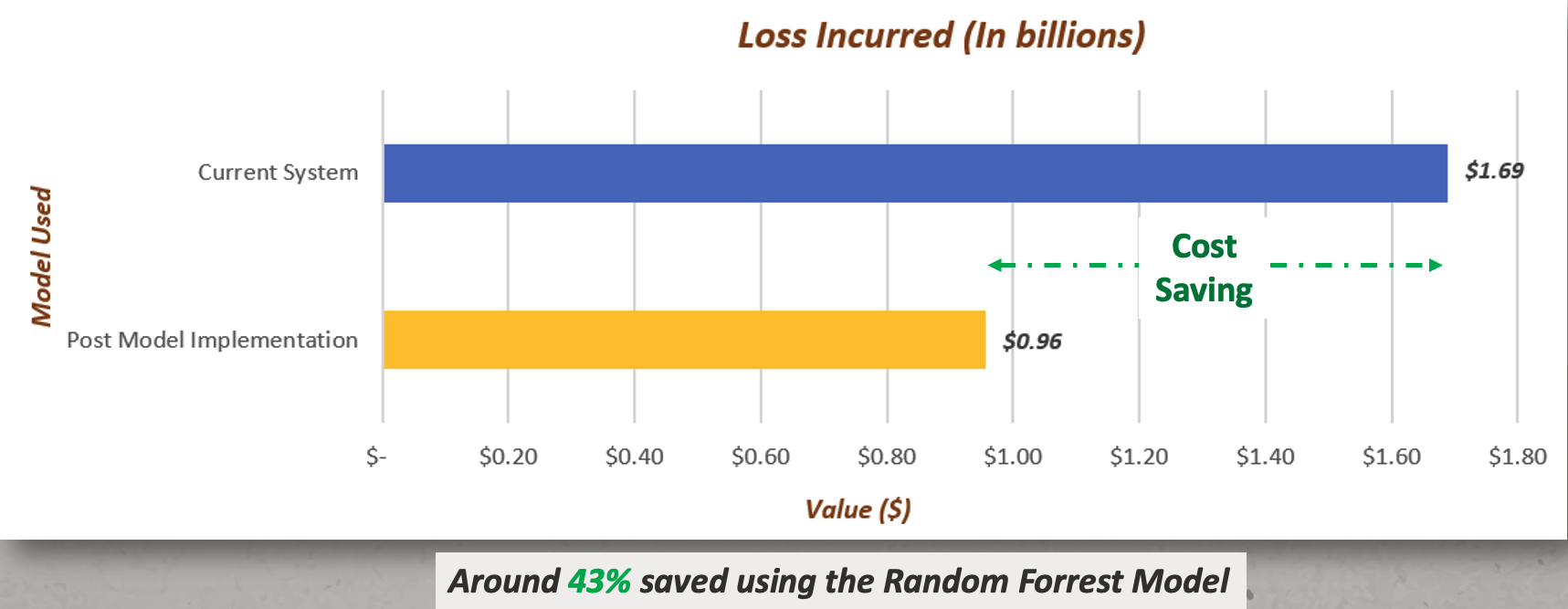

Universal Plus loans money to their clients to be paid in a fixed term. In the past, some of their clients were unable to repay the loans on their debt obligations and their loans went into default. Lending money without considering the potential defaults can result in huge losses. Therefore, Universal Plus wants to proactively anticipate the defaults with a credit risk management system. This system is required to predict which customers is likely to default in their loan payment in the future. Having such a system will ensure that Universal Plus can identify their credible and not credible customers, and take proactive steps to control the risks. Several other consultancy companies have been approached as well, and the final decision on who will get the contract will largely depend on the outcome of a demonstration of the approach to this problem based on a dataset that Universal Plus provided. The dataset contains 31,375 instances of historic loan applications.

Features

- ETL (Extract-Transform-Load)

- Data Engineering

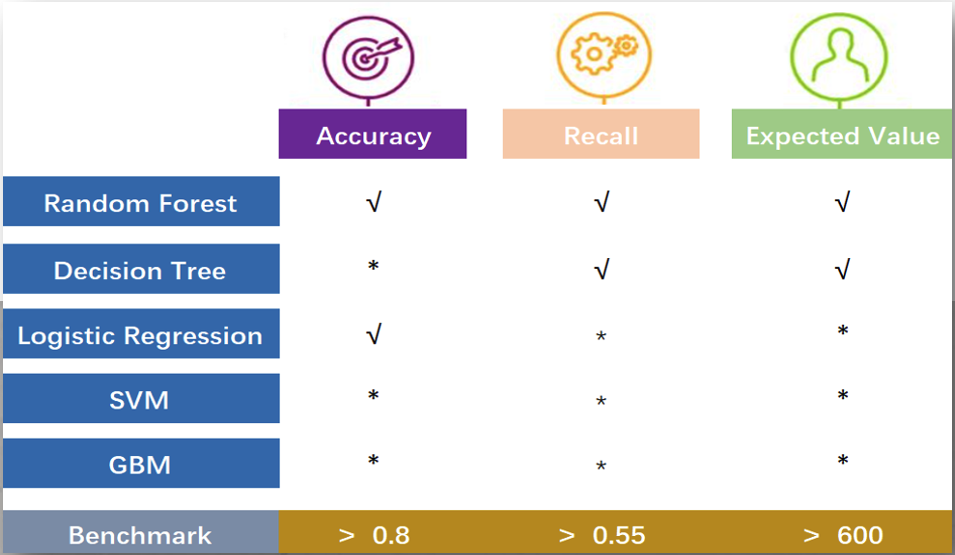

- ML Algorithm (SVM, RG, GB, Regression, Decision Tree)

- Information Gain

Some of the highlights and visualisations of the project are as follows: